COVID-19 pandemic has been a big driving factor in the surge of the stock market app recently. Moving forward, this trend of trading through smartphone apps is going to pick up as it enables users to have real-time access to key information related to investment and trading.

Recently Freetrade, a London-based challenger stockbroker company, raised a $69 million (approx £50 million) Series B round at a post-money valuation of $366 million (approx £265 million).

On the other hand, eToro, the social trading, and investment marketplace plans to go public through SPAC (Special Purpose Acquisition Company) merger in a $10B (approx £7.2 billion) deal. Further, Trading 212 announced that it will implement a 0.15% fee on all trades of stocks or ETFs for foreign currency.

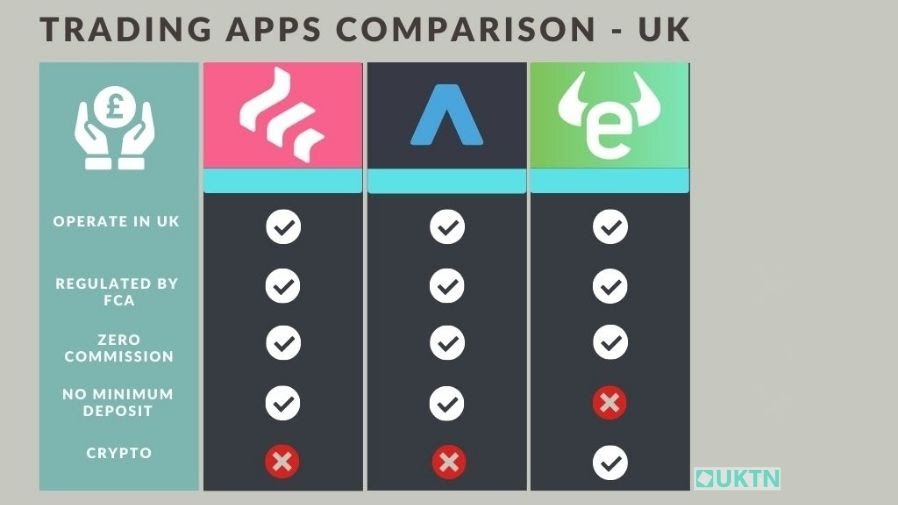

Already, eToro, Freetrade, and Trading 212 are very popular investment services and have exploded in popularity in recent years. In this article, we’ve put together the comparison to discuss Freetrade vs eToro vs Trading 212, their pros and cons, and which is suitable for you.

eToro

eToro is one of the best stock trading apps for beginners available to UK investors. The platform allows users to buy, sell and trade numerous stocks with 0% commission fees.

However, eToro applies a currency conversion charge of 0.5% to deposit currencies that are not US dollars. Compared to Freetrade and Trade 212, eToro offers a broad range of investment options including 1,700+ stocks from over 17 UK and international markets.

Further, the platform allows users to trade indices, Exchange-Traded Funds (ETFs), forex, cryptocurrencies, and commodities (oil, natural gas, gold, silver, and other products). To buy shares, the minimum deposit is $200 and a minimum of $50 has to be paid per stock.

Notably, eToro also allows ‘Copy Trading’ that allows you to copy the trade of an experienced investor.

Pros

- Regulated by the FCA and covered by the FSCS

- Zero commission

- Copy and Social trading

- 1,700+ stocks listed

Cons

- High first time deposit

Trading 212

Trading 212 offers a mobile trading app with the full functionality of a desktop platform. The app offers access to more than 10,000 stocks and ETFs in several UK and international exchanges. The trading platform offers access to high-risk CFDs as well.

Unlike eToro, Trading 212 doesn’t have any minimum deposit threshold. This trading app is an excellent option if you are new to the stock market space. Also, users can utilise the demo account facility without opening an account.

Pros

- Regulated by the FCA and covered by the FSCS

- No minimum deposit

- Zero commission

- Supports CFD trading

Cons

- Not-so-popular

- Limited product portfolio

Freetrade

Founded in 2016, Freetrade offers access to more than 4000 shares, investment trusts, and ETFs. However, it does not offer any access to open-ended funds. Like other platforms, Freetrade is 100% free but users need to pay 0.45% on investments as a foreign exchange fee.

In this platform, there is no limit on how many can be placed each month. With a premium account costing £9.99 a month, users can access a wider range of investments such as FTSE Aim all-share stocks.

Pros

- Regulated by the FCA and covered by the FSCS

- Zero commission

- Easy account opening

Cons

- Mobile-only

- Basic product portfolio

Conclusion

To conclude, all three platforms are zero fee investing platforms and regulated by the FCA and covered by the FSCS. They offer excellent services and user-friendly UI as well. In terms of a winner, it boils down to user preference and liking. However, if you are a beginner Trading 212 is a better platform, to begin with. If you are interested in social and copy trading, eToro is the obvious option.

Freetrade is the best option if you are not bothered too much about having access to a wide range of global ETFs and stocks. While, Trading 212 has a great interface and lots of features.

The post Freetrade vs Trading 212 vs eToro: Which is the best stock trading app in the UK? appeared first on UKTN (UK Tech News).